Heavy Equipment Financing & Leasing Solutions For Small Businesses

We understand the pivotal role heavy machinery plays in driving industries forward. Our dedicated financing and leasing solutions are tailor-made for those looking to acquire state-of-the-art equipment without the burden of a full upfront payment. Our offerings cover a wide range of machinery, ensuring you have the financial support you need, when you need it.

We often receive inquiries from individuals about heavy equipment loans, especially when they plan to use them for personal endeavors, such as landscaping a newly-acquired land or for larger home-based projects.

Regrettably, the current market doesn’t cater to such personal-use requests. Loan underwriters primarily evaluate the potential revenue stream that will be generated from the utilization of the equipment.

To be eligible for an equipment loan, you must own an operational business.

How to Qualify for Heavy Equipment Financing?

Many business owners, with either reasonable credit scores or collateral, can qualify for some sort of financing. However, obtaining business financing can sometimes be like solving a puzzle. There can be various elements that, when misaligned, can hinder a deal.

Like other types of machinery, heavy equipment, in general, is comparatively easier to finance than several other business assets.

What Down Payments are Needed on Heavy Equipment?

The down payment largely depends on the financing program you’re eligible for. Typically, the better your credit score and the longer you’ve been in business, the lower your initial cost will be.

With an established business and good credit, you might be looking at a down payment of about 5%, so, for instance, $5,000 on a $100,000 machine. Depending on the best-fit program, you may need to make one or two payments upfront. New businesses usually make the first and last payments upfront.

For those on a fair credit program, you might need to make the first and last payments or sometimes the first payment plus a 10% security deposit.

On the other hand, bad credit programs might require a 10-20% security deposit, the first payment plus a 10% security deposit, or even additional collateral. This collateral can be any valuable asset such as other machinery, vehicles, or property.

Will the Equipment I’m Purchasing Qualify for Financing?

Lenders typically shy away from financing substandard equipment. The reason is straightforward: if the machinery fails and disrupts your business’s revenue stream, the likelihood of loan repayments diminishes.

Generally, the equipment’s age and condition play a significant role in financing decisions. If the machinery is under 10 years old and comes from a credible dealer, securing a loan is usually straightforward. Between 10-15 years, if the equipment’s source is reputable, financing shouldn’t be an issue.

In most scenarios, even with older machines or those with significant usage, your heavy equipment should qualify for financing if it’s in good condition and sourced from a trusted dealer.

What Kind of Equipment Can I Finance or Lease?

1. Construction and Earthmoving Equipment:

Hydraulic excavators, bulldozers, motor graders, wheel loaders, backhoe loaders, trenchers, skid steer loaders, and tower cranes.

2. Mining Equipment:

Large haul trucks, draglines, continuous miners, blasthole drills, and longwall mining systems.

3. Agricultural Machinery:

High-horsepower tractors, combine harvesters, forage harvesters, self-propelled sprayers, and cotton pickers.

4. Forestry Equipment:

Feller bunchers, skidders, forwarders, and harvesters.

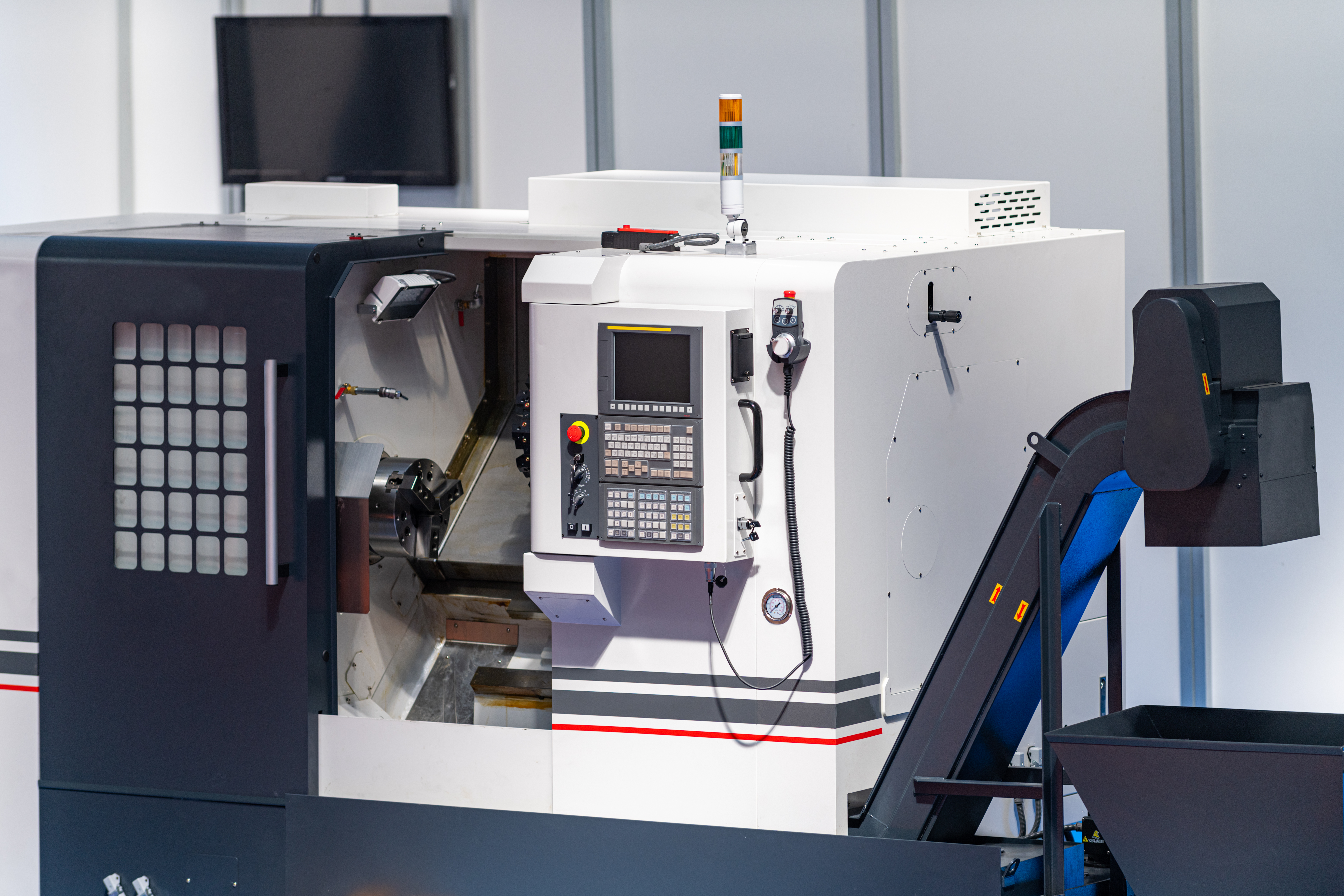

5. Manufacturing and Production Machinery:

CNC machines, injection molding machines, metal stamping presses, and robotic welding systems.

8. Transportation and Lifting Equipment:

Heavy-duty trucks and trailers, mobile cranes, container handlers, and high-capacity forklifts.

9. Paving and Roadwork Equipment:

Asphalt pavers, milling machines, road rollers, and concrete mixers.

10. Energy and Power Generation Equipment:

Wind turbines, solar panel manufacturing machinery, and large diesel generators.

11. Waste and Recycling Equipment:

Industrial shredders, balers, compactors, and recycling sorters.

Frequently Asked Questions

Heavy Equipment Financing FAQs

What is the difference between financing and leasing heavy equipment?

Financing involves a loan to purchase equipment, where you’ll eventually own the equipment once the loan is repaid. Leasing is like renting, where you use the equipment for a certain period and return it at the end of the lease, or opt to purchase it.

How do I qualify for equipment financing or leasing?

Eligibility usually depends on your credit score, business history, and financial health. However, each application is reviewed on its merit, so we recommend contacting our team for a personalized assessment.

Can I finance used equipment?

Absolutely! We offer financing solutions for both new and high-quality used equipment.

What are the typical terms for equipment leasing or financing?

Terms can vary based on the equipment type and your business needs. Generally, they range from 12 months to 60 months or even longer.

Are there any down payments required?

Down payment requirements can vary. In many cases, we offer 100% financing, but specifics depend on the equipment type and the financial product chosen.

What happens at the end of a lease term?

At the end of a lease, you typically have options to return the equipment, purchase it, or extend the lease. The choice is yours!

Can I end the lease or financing contract early?

Early termination conditions depend on the contract. There might be penalties or buy-out options available. It’s best to review the contract details or consult our team.